how to pay indiana state tax warrant

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

INtax only remains available to file and pay the following tax obligations until July 8 2022.

. When the tax is paid a Satisfaction of Lien is mailed to the Clerk who then has to look up the old tax warrant in the Judgment Book and record the Satisfaction. Hamilton County Sheriffs Office 18100 Cumberland Road. If you cant pay your tax debt in full you may be able to set up an installment payment agreement IPA to prevent additional collection action.

Doxpop provides access to over 13062400 current and historical tax warrants in 92 Indiana counties. Taxpayers are provided an opportunity to either. These taxes may be for individual income sales tax withholding or corporation liability.

Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. Enter PLC Pay Location Code is 7765 to be directed to Porter County-Civil Bureau-Tax Warrants. The DOR also sends the Clerk a check for 300 for each tax warrant filed.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. Know when I will receive my tax refund.

Claim a gambling loss on my Indiana return. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. SF 56196 Expungement Request Form.

Where do I go for tax forms. Using the e-Tax Warrant application the DOR provides an electronic file with tax warrants to be processed by Circuit Court Clerks. How to Pay Indiana State Taxes Step 1.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Send in a payment by the due date with a check or money order.

Tax Warrant Payment Methods. ATWS is a software package that streamlines the handling of Indiana Tax Warrants. The Indiana Department of Revenue first files a lien at the County Clerks Office then forwards a copy to this office.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. You can also pay.

Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and. Submit the form and well contact you with more information on how your Indiana County can benefit from ATWS. In order to qualify for an expungement you must first pay all outstanding tax liabilities and be current on all tax filings.

Request a No-Obligation Consultation. We will also notify the Department of State that the tax warrant has been satisfied. Take the renters deduction.

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Why did I receive a tax bill for underpaying my estimated taxes. Mail - Payable to.

Where can I get information about the 125 Automatic Taxpayer Refund. Find Indiana tax forms. Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the.

Pay by telephone using. Answered 5 years ago. You must include Your county and warrant number with all correspondence.

Lieberman Technologies is proud to provide Indiana Sheriff offices with Automated Tax Warrant System ATWS. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC. These should not be confused with county tax sales or a.

Our service is available 24 hours a day 7 days a week from any location. We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. 734 out of 1441 found this helpful.

Revenue Department of 19 Articles. Decide on your method of payment. If you set up an IPA the warrant will remain on file.

Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. To be considered for a tax warrant expungement you must submit a completed. Was this article helpful.

Saved Tax Warrant Searches. Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years. When you receive a tax bill you have several options.

Lives in Zionsville Indiana. Have more time to file my taxes and I think I will owe the Department. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247.

Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxes you must contact them immediately to. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. As part of the Tax Amnesty 2015 program eligible taxpayers are allowed to submit a request to have tax warrants expunged from their records.

Pay my tax bill in installments. You can pay with credit cards online or over the telephone. You must pay your total warranted balance in full to satisfy your tax warrant.

However circuit clerks using the INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail.

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid

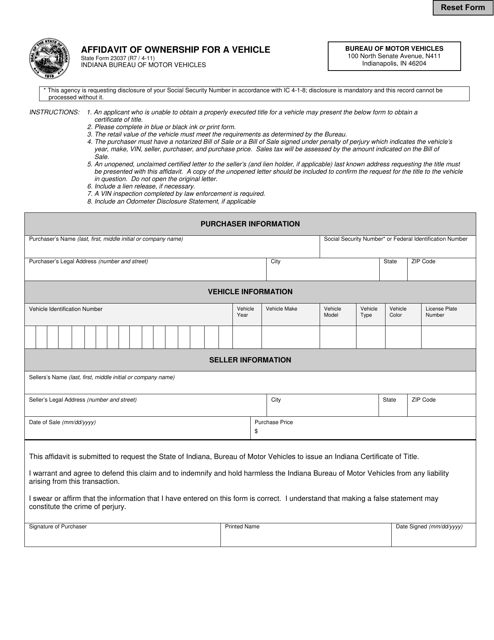

State Form 23037 Download Fillable Pdf Or Fill Online Affidavit Of Ownership For A Vehicle Indiana Templateroller

Indiana Tax Relief Information Larson Tax Relief

Indiana Tax Relief Information Larson Tax Relief

Dor Indiana Extends The Individual Filing And Payment Deadline

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

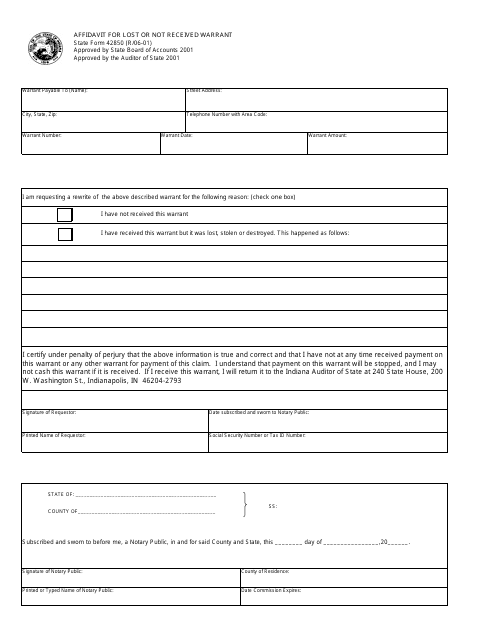

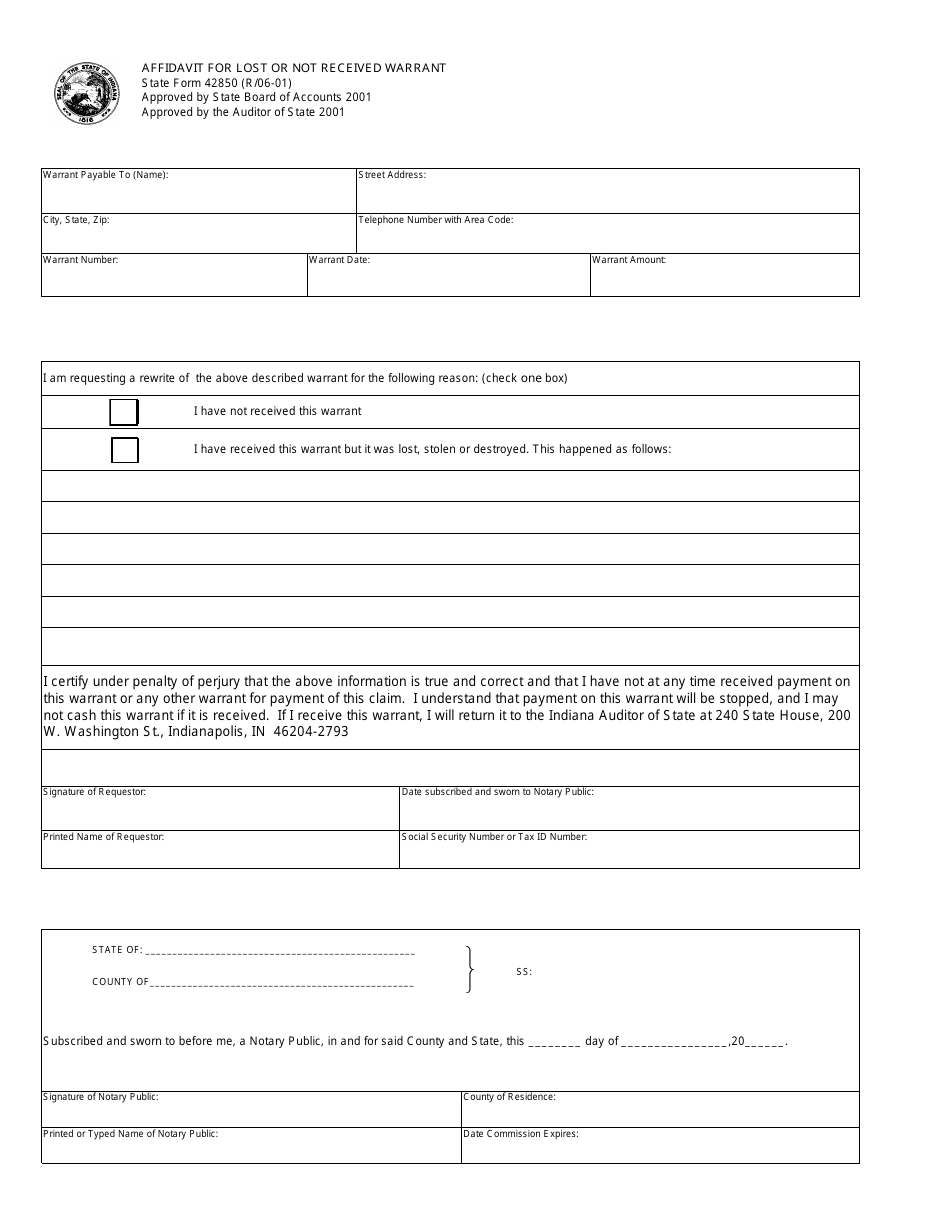

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Dor Owe State Taxes Here Are Your Payment Options

Dor Indiana Individual Income Tax Tips Payments And Refunds

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Unfortunate But Familiar Indiana Dwd Warns Of Rise In Unemployment Fraud Wane 15

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

True Cost To Start An Indiana Llc Optional Required

Dor Keep An Eye Out For Estimated Tax Payments

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org